By Kalinga Seneviratne

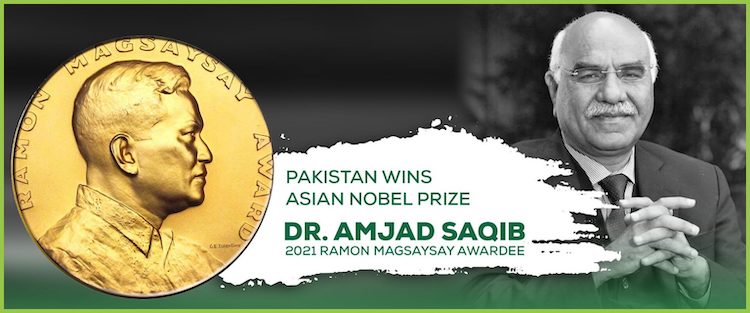

SYDNEY (IDN) — One of the five winners of this year’s Ramon Magsaysay Awards—known as Asia’s Nobel Prizes—is Dr Muhammad Amjad Saquib the founder of Pakistan’s biggest community development network Akhuwat that is based on Islamic principles of sharing and brotherhood. (P15) INDONESIAN | JAPANESE TEXT VERSION PDF | PORTUGUESE

Launched in 2001, hundreds of thousands of poor families have been supported through Akhuwat’s interest-free microfinance loans. Islamic law prohibits interest on loans, but Islamic teachings that encourage followers to set aside a portion of one’s wealth to help the needy assist to finance this model.

“It is definitely an Islamic development model,” argues Fatimah Shah, a Pakistani international development professional. “Akhuwat’s no-interest financial model, where lending is based on trust and encourages options for group lending to foster a sense of community; is fundamentally rooted in core Islamic values.“

Akhuwat’s core program, Akhuwat Islamic Microfinance (AIM), provides interest-free loans to the underprivileged to enable them in creating sustainable pathways out of poverty. With 800 plus branches in over 400 cities across Pakistan, AIM is the largest interest-free microfinance program in the world.

Dr Saquib was intellectually and professionally well prepared for the role when he embarked on setting up Akhuwat. After graduating from King Edward Medical College in Lahore, he completed a Masters’s degree in Public Administration from American University Washington through a Hubert Humphries Fellowship. From 1985 to 2003 he served in the civil service of Pakistan during which he realized that government programs were not designed to help the poor, especially the women—even when they claim to do so.

Akhuwat has “adopted” hundreds of neglected and non-functioning public schools and established four residential colleges (one of them for women), and soon a university, for poor and deserving students. Established in 2015, Akhuwat College is a residential college that caters to students from low-income households who despite their talent and desire to pursue education, are unable to do so due to financial constraints. Their Learning Hubs provide education and vocational training to children of unknown parentage, who are often found in alleys plagued by drugs, prostitution, and violence.

The organization encourages the education of women, and Akhuwat College for Women and their website says that its philosophy is based on “the firm belief that no nation can progress without investing in the education of women”. Located in Chakwal, the Akhuwat College for Women is a residential campus, housing women from all over the country with young women who receive merit-based admissions.

Akhuwat runs a health services program, helping hundreds of thousands of patients; a “clothes bank” that has distributed more than three million clothes for the needy; and a program of economic, health, and psycho-social services for the discriminated khwajasira (transgender) community.

In nominating Dr Saquib to receive the 2021 Ramon Magsaysay Award, the board of trustees said in the citation that they “recognize the intelligence and compassion that enabled him to create the largest microfinance institution in Pakistan; his inspiring belief that human goodness and solidarity will find ways to eradicate poverty; and his determination to stay with a mission that has already helped millions of Pakistani families”.

Dr Saqib dedicated this award to the poor beneficiaries of Akhuwat and to the Pakistani nation. He said this award is an endorsement of Akhuwat, interest-free lending model, and a tribute to the compassion and integrity of his nation. Pakistan’s Prime Minister Imran Khan in a tweet congratulated Dr Saquib for winning “Asia’s highest honour” and he added: “We are proud of his achievement as we move forward in creating a welfare state based on Riyasat-e-Madina Model.”

“Akhuwat in its entirety—its name, its central philosophy, its slogan of Iman-Ihsan-Ikhlas (faith-kindness-sincerity), and its financial approach is designed on Islamic social and financial principles. Akhuwat is derived from Mawakhaa’t which means Brotherhood; a principle that defined the way the Prophet catalyzed the integration of immigrants from Makkah into the social and financial fabric of Yathrib (Medina),” Fatimah explained to IDN in an interview.

Akhuwat’s success is another example of how the global banking model based on interest payments fuelling the system is not serving the poor. “It is a phenomenal story even in sheer numbers; starting with a single loan of less than 200,000 Pakistani Rupees (approximately, 3000 USD) in 2001, to over 140 billion Pakistani Rupees worth of interest-free loans that continue to help over 20 million people.“ Amjad Saqib has successfully managed to manifest his empathy and selflessness into a cyclic social endeavour. His philosophy is not just to do good himself, but to encourage and help others in joining hands to help” Fatimah adds.

Akhuwat uses places of worship for loan disbursements, saving on costs, and also promotes volunteerism among staff and clients. It aims at transforming borrowers into donors.

Akhuwat model is sometimes compared to the famous Grameen Bank model of Professor Muhammad Yunus from fellow South Asian predominantly Muslim nation of Bangladesh. But the Grameen model does charge interest on its micro-loans. There are similarities in the two models, says Dr Faiz Shah, Director of Yunus Center at the Asian Institute of Technology in Bangkok. “Primary function of both organizations is to provide access to finance through social capital and social collateral,” he adds, “loaning to the unbankable, that is the similarity”.

Dr Faiz points out that Professor Yunus has never claimed that Grameen Bank is an Islamic model. “It’s simply a loan program that is sometimes seen as savings and loan program. It is driven by a commitment to social development. The Grameen principle is that anyone who subscribes to a Grameen programme would contribute to a community building or nation-building program,” he explained to IDN. “Akhuwat is simply driven by a motivation to tap into a reservoir of Islamic welfare funding. Which is enunciated in the principles of the Islamic faith… motivated by the principle of brotherhood in Islam.”

Today, Akhuwat is the largest microfinance institution in Pakistan, offering a package of loans for the poor. It has distributed 4.8 million interest-free loans amounting to the equivalent of USD 900 million, helping three million families, with a remarkable 99.9% loan repayment rate. In the Covid-19 pandemic, Akhuwat responded with emergency loans and grants, food relief, and other assistance in over a hundred cities in Pakistan.

Dr Faiz, who is a Pakistani, points out that it’s important to underscore the fact that one of the tenants on the five pillars of Islam is charity, in which one-fortieth of whatever one earns has to be spent in a way to helping another human being through a difficult time. “The state can administer this, but it’s also a personal obligation on Muslims,” he says.

“Muslims can do it in a variety of ways, and this percentage has to be deducted from any holding that a Muslim has and be spent for community development or helping people in need” explains Dr Faiz. “You could say that the inspiration of Akhuwat is very firmly rooted in the Islamic development model, (adopted to) modern times, in its modern implementation or its modern interpretation of the application.” [IDN-InDepthNews — 15 September 2021]

Photo: Asian Nobel prize winner, Muhammad Amjad Saquib, the founder of Pakistan’s biggest community development network Akhuwat. Credit: Akhuwat.